RiskLab, founded in 1994 and reorganised in 1999, is a «crystallisation

point» for applied research in the area of risk management and an

intersection point for universities and the financial sector; a model of

wide-ranging co-operation.

RiskLab, founded in 1994 and reorganised in 1999, is a «crystallisation

point» for applied research in the area of risk management and an

intersection point for universities and the financial sector; a model of

wide-ranging co-operation.

RiskLab, founded in 1994 and reorganised in 1999, is a «crystallisation

point» for applied research in the area of risk management and an

intersection point for universities and the financial sector; a model of

wide-ranging co-operation.

RiskLab, founded in 1994 and reorganised in 1999, is a «crystallisation

point» for applied research in the area of risk management and an

intersection point for universities and the financial sector; a model of

wide-ranging co-operation.

By Andreas Luig

«Mathematical knowledge is increasingly important; today's manager must be able to analyse and understand quantitative models.» J. Ackermann, then President of the Swiss Creditanstalt, said this in 1993 in an interview with the economic magazine «Cash». The background of this statement was the rapid development of derivative deals at the beginning of the 90s, together with the subsequent need for quantitative risk management.

With this need in mind, RiskLab was founded in 1994 as an applied research institute by universities and participants from the finance industry. The project was launched on the incentive of the then three big Swiss banks, the Union Bank of Switzerland, the Swiss Creditanstalt and the Swiss Bank Cooperation, and on the initiative of two ETH professors, Paul Embrechts and Hans-Jakob Lüthi. RiskLab aims to develop and support practical research efforts in a pre-competitive phase. Each research project is embedded in questions relevant to practice.

Originally conceived as a virtual platform, RiskLab has developed to become a real-world research unit with a widespread co-operation network. Currently, UBS, the Credit Suisse Group and Swiss Re contribute towards the research unit. The rooms and infrastructure, as well as two post-doctoral positions, are financed by the ETH Zurich. This method of co-operation provides adequate financial resources for the research unit, says Uwe Schmock, Research Director of RiskLab since 1999, and compares favourably to similar institutions in other countries.

RiskLab is firmly embedded in the Swiss research landscape. Close co-operation is fostered between the three professorships for Mathematical Finance, Insurance Mathematics and Operations Research of the ETH Zurich. In addition RiskLab collaborates on certain projects with other ETH professors, as well as with researchers from the Universities of Zurich, St. Gall and Lausanne and with INRIA Sophia-Antipolis in France.

The management of RiskLab continues to be determined by a high degree of consensus, as Uwe Schmock says (cf. following interview). A supervisionary board, made up of the Vice-President of Research of the ETH Zurich and the Chief Risk Officers of the participating companies of the finance sector, decides the terms of the global budget and steers the basic research strategy. Concrete research activity is determined by an executive committee comprising the Research Director of RiskLab, the three ETH professors and one expert from each partner from the finance sector. An assessment committee of leading international finance experts, to be set up next year, will examine and evaluate projects carried out at RiskLab.

In the short time since its founding, RiskLab has made a name for itself in specialist circles. Schmock emphasises the importance of «informational activity». The fulcrum and pivot for this type of activity is RiskLab's internet site, www.risklab.ch, which lists all current research projects together with the corresponding researchers and the names of contact people at partner institutions. It also gives research results in the form of articles, and informs on forthcoming lectures and events.

Numerous events have played an important role in building the network of RiskLab's wide-ranging contacts. For example, RiskLab mounts an annual «Risk Day», and organises regular workshops based on results of projects. It also fulfils teaching contracts, arranges guest talks and supervises diploma theses that are relevant to current research projects. «In this way we have been able to build up a wide network of contacts in research and companies, while, at the same time, offering our staff an attractive workplace where they can interact at many levels», says Schmock.

RiskLab will continue to be a dynamic institution capable of change and development. The addition of further finance companies would be desirable. It is Schmock's conviction that contacts between RiskLab and regulators should be intensified. New regulatory guidelines, such as those foreseen in the «Basle II accord» could then be taken into consideration of the applied research projects at an early stage.

Projects in other countries imitating what was being done at RiskLab soon after its founding prove that the concept answers the international needs of universities and industry.

Further information: www.risklab.ch

|

|

Anyone wanting to comprehend RiskLab's research

will need a sound understanding of mathematics. |

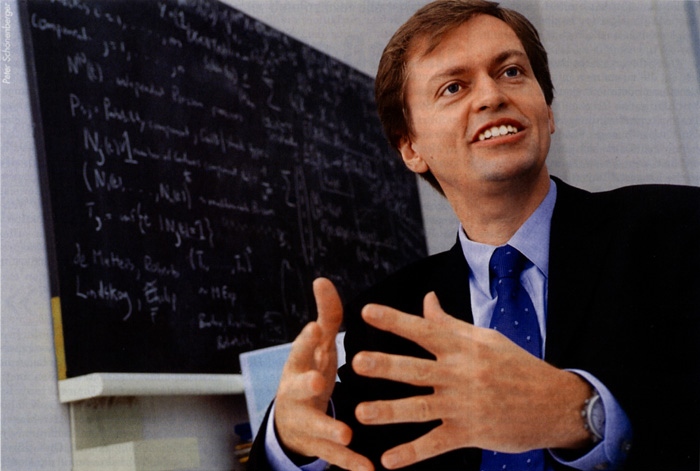

INTERVIEW: Dr. Uwe Schmock, Research Director of RiskLab at the ETH Zurich

Zurich as a finance centre needs a great number of highly qualified finance experts. Uwe Schmock, Research Director of RiskLab at the ETH Zurich, tells us about the contribution his unit is making towards achieving this goal.

Andreas Luig talks to Uwe Schmock

The research carried out at RiskLab is purportedly strictly pre-competitive. How is the distinction made between what constitutes pre-competitive and what is already competitive?

The limits are not easy to define; each case requires individual assessment. In practice, however, this has never posed problems as the executive committee, which has to agree on each project carried out, is made up of delegates from all contributing parties.

What concrete advantages does RiskLab offer to participating financial institutions?

RiskLab is a platform for collaborative research. Participating companies help to determine the subjects of research, actively participate in the actual research, and are the first to be informed, at first-hand, of results. Indirectly, RiskLab supports the success of the company by facilitating the flow of basic research results, especially in the area of risk management.

The three participating companies, CS Group, UBS and Swiss Re, all support RiskLab but are competitors in the market place. Is this a cause for controversial discussions when it comes to deciding on research themes?

RiskLab acts as a «crystallisation point» for collaborative research. Input for research projects does not come solely from the three participating financial institutions but is also the result of international exchanges between researchers. Many stimulations for our projects emerge at the universities — precisely this knowledge is to be put at the disposal of the finance sector. Big differences of opinion rarely occur when it comes to choosing the subject of research. There is a high degree of readiness to compromise in the executive committee, a strong will to co-operate and a common vision. Cause for discussion is more often the exact focus of a research project and its potential scientific value.

Does RiskLab carry out only mandated projects or does it also function as an independent research unit?

Emphasis is placed on projects, which we define together with the three participating companies. In addition, RiskLab employs two postdoctoral researchers, who enjoy academic freedom when it comes to determining the subject of their research, which, up until now, has concentrated on questions of finance and insurance mathematics. RiskLab also supervises certain diploma or seminar theses which deal with aspects of research projects. The range of RiskLab's activities is thus quite wide.

One of RiskLab's goals is to heighten the attractiveness of Zurich as a financial centre. Has this goal been reached?

As a financial centre Zurich needs a great number of qualified finance specialists, as indeed does the rest of Switzerland. Even within Switzerland, it is difficult to educate and train an adequate number of specialists. This makes it even more important to be able to attract foreign specialists to Zurich. I am convinced that RiskLab helps to make Zurich more attractive. We have good contacts to research institutes and industry, are invited to speak at international symposia, and we publish our research results on the internet, thus making them available to interested parties the world over. The fact that RiskLab currently has citizens from the USA, Denmark, Germany, Romania, France, Sweden and Turkey working together shows that our efforts in this direction have had a positive effect.

How do you secure links to practice and circumvent the danger of working from an «ivory tower»?

![]() This danger is practically nullified by the way we are organised and the

way we work. And besides, for the main part, our projects run on an annual

basis. This means that it is essential to deliver concrete results. In

addition, our staff give

talks at specialist conferences

and cultivate a continuous exchange of views with specialists from other

universities, as well as with companies from the private sector.

I see RiskLab as a good example of the way in which close co-operation between

academic research and industry can be nurtured. Increasing competition requires

that knowledge and insights gained at the universities flow rapidly into the

daily activities of companies and, inversely, that challenges and questions from

the private sector can flow back to researchers.

This danger is practically nullified by the way we are organised and the

way we work. And besides, for the main part, our projects run on an annual

basis. This means that it is essential to deliver concrete results. In

addition, our staff give

talks at specialist conferences

and cultivate a continuous exchange of views with specialists from other

universities, as well as with companies from the private sector.

I see RiskLab as a good example of the way in which close co-operation between

academic research and industry can be nurtured. Increasing competition requires

that knowledge and insights gained at the universities flow rapidly into the

daily activities of companies and, inversely, that challenges and questions from

the private sector can flow back to researchers.

Wouldn't it make sense to extend the support base by including other important institutions around Zurich, such as Zurich Financial Services or the Zurcher Cantonalbank?

In principle, a wider supportive base and a certain balance between banks and insurances would be worth striving for. We have had contacts with both branches of finance with a view to realising this. I could well imagine for example, Swiss Life as an additional participant. For the moment, however, no concrete plans are in the pipeline.

What does your own ideal RiskLab look like?

Currently, we employ 12 researchers. An ideal size would be about 15 people. If RiskLab were any bigger than that, it would be difficult for one research director to closely survey all projects. Also, I would welcome a longer-term planning time frame for RiskLab as an institution. When it was re-organised in 1999, RiskLab's future was secured for 3 plus 2 years. This means that the first evaluation will take place next summer and a decision taken on how we will proceed. While from the point of view of a research unit regular evaluation is certainly desirable, a longer-term orientation would be good. This is especially important for the outstanding young researchers who come to us at RiskLab to work on their doctoral theses. One resulting challenge to all participants is to find a justly-balanced connection between a practically-oriented mandated project and the high academic requirements of a thesis for the Department of Mathematics of the ETH Zurich. Or, to put it another way, new mathematical methods arising from a thesis can be applied immediately while its proof serves more as a basis for future discoveries. Here a compromise has to be found to ensure financial support during the last phase of a thesis.

What were the main subjects of research projects up until now?

Following on from the core competences of the participating researchers the emphasis until now has been on five themes, or a combination of the five: capital allocation, application of extreme value theory, modelling of static and dynamic dependencies, quantification of model risks and modelling of (il)liquidity. Also numerical and statistical questions. Finished research reports on our web server already take up about 1500 printed pages, not counting presentation transparencies.

What can companies learn from all this?

To take just one example, they can gain knowledge about how much risk capital they must put aside to cover extreme, possibly dependent losses. This is an extremely important factor as far as credit default risk is concerned. Or we provide companies with quantitive knowledge on the impact that new rules set out by regulatory bodies might have on their business.

Can an interested non-specialist profit from your research results or is a specialist education necessary to understand them?

A quantitative-mathematical education is certainly of great advantage if anyone wants to fully understand our research. But I think anyone interested in our results has the wherewithal to understand them — finding the time required to do so is the great challenge!

Professional training:

Mathematics and physics at the

Technical University, Berlin and

the

California Institute of Technology.

Doctoral degree from

TU Berlin in 1990

for a thesis in the area of probability theory: «On the maximum

entropy

principle for Markov chains and processes» under the supervision of

Prof. Bolthausen.

Subsequently, 5 years postdoctoral research at the

University of Zurich

as assistant to

Prof. Bolthausen and 4

years as

Credit Suisse

Research Fellow at the

ETH Zurich in

Prof. Delbaen's

group. Research Director of

RiskLab since 1999.

| Back to Press Publications about RiskLab | German version |