| Quantitative Finance, Vol. 2, No. 6 (Dec. 2002) 402-404 | Profile: RiskLab, ETH Zurich |

|

| Figure 1. ETHZ building

(© Susi Lindig, ETH Zurich, click to enlarge). |

'Research in Risk Management: Major banks establish a research collaboration. According to a press announcement, the three major banks have founded a common research platform in the field of finance. The aim of this platform is to undertake joint applied research in finance together with relevant universities. A first concrete research contract was made between the Schweizerische Bankgesellschaft (SBG), the Schweizerische Kreditanstalt (SKA), the Schweizerische Bankverein (SBV), and the Swiss Federal Institute of Technology Zurich (ETHZ). Under the name of RiskLab, researchers from the ETH will study concepts, models and techniques from the realm of global risk management and risk monitoring. Every project funded should have a concrete practical question at its basis. Besides other Swiss banks, it is also hoped to get national and international regulatory bodies involved towards the formulation of an appropriate research programme.'

Neue Zürcher Zeitung, 7 October 1994

In the wake of the 1988 BIS Accord, the early 90's saw an intensive discussion on issues such as portfolio effects and netting. By not properly addressing these issues in the 1988 Accord, banks were faced with unsatisfactory risk-based capital rules. Discussions, within industry and with the regulators, led to the 1996 Amendment which became, for instance, mandatory for all US financial institutions with significant trading activities as of 1 January 1998. Notions like marked-to-market, netting, value-at-risk, RAROC became the bread and butter of quantitative risk managers in financial institutions worldwide. At the same time, generally accepted risk principles (GARP) changed the organizational structure of those institutions. For details on this, see Crouchy et al (2001) or www.bis.org.

RiskLab was founded in order to bring an academic component into the discussion between the banks and the regulators on questions related to quantitative risk management. Through the regulatory framework, then (the 1988 Accord, the 1996 Amendment) as well as today (Basel II), it plays an important role in setting the overall research programme and, since the beginning, concrete research proposals have concentrated on specific technical questions. Examples of the latter include the statistical estimation of correlations, an analysis of the square-root scaling rule for VaR and the establishment of risk measures over long-time horizons (e.g. a year). The latter example is one typically encountered in the bank assurance or indeed reinsurance business. It has always been one of the key drivers of ETHZ-based research in risk management to integrate actuarial (insurance) thinking with quantitative (banking related) finance methodology.

Over the years, RiskLab's founding industrial partners changed: two of them merged (SBG and SBV) to become UBS, SKA became part of a larger all-finance group Credit Suisse Group (CSG, also includes the insurance company Winterthur) and the Swiss Reinsurance Company (Swiss Re) joined a little later as a new member. Projects were not only worked on at the ETHZ, but also at the University of Zurich (UNIZH) and the Universities of St. Gallen and Basel. Under its Scientific Director Uwe Schmock, in the late nineties, RiskLab achieved visibility beyond the Swiss boundaries, see www.risklab.ch.

One of the other reasons for the industrial support of RiskLab was the desire to make Zurich a truly academic centre of competence of quantitative finance and insurance. This should not only attract top students and academics but also make Zurich a focal point for research and teaching in these fields. The professors that started the RiskLab initiative, Lüthi (operations research) and Embrechts (insurance mathematics), have since been joined at the ETHZ by Delbaen (mathematical finance), McNeil (econometrics), Rheinländer (mathematical finance) and, most recently, Schönbucher (quantitative risk management). A further professorial position is currently being filled in the field of quantitative finance. At the same time, the University of Zurich built up its academic resources in the field through professors Gibson (finance), Hens (financial economics and monetary macroeconomics) and Habib (corporate finance) adding to a strong group of economists already present in Zurich. Excellent quantitative research groups exist at the Institute for Empirical Research in Economics (www.iew.unizh.ch) and the Swiss Banking Institute (www.isb.unizh.ch). Through supervision at the PhD level, these institutes, as well as the Department of Mathematics at the ETHZ, play a fundamental role in safeguarding the academic/scientific component of the research done at RiskLab. Over recent years, teaching and research in finance and insurance has been further enhanced. The University of Zurich, as well as the ETHZ, offers a full teaching programme in actuarial mathematics recognized by the Swiss Actuarial Association (www.actuaries.ch). These programmes lead to the diploma of certified actuary according to the rules of the EU's Groupe Consultatif. From the academic year 2002/2003 onwards, a new Masters Programme in finance has been established jointly by the ETHZ (Department of Mathematics) and the UNIZH (Swiss Banking Institute); see www.msfinance.ethz.ch.

| It's main objective is to develop a unified concept

to understand and analyse the dynamics of real and financial wealth

creation. |

I will now discuss some examples of research coming out of RiskLab. Readers interested in more organizational issues, or further details on the numerous RiskLab projects are advised to visit the web page www.risklab.ch/Projects.html. Further information on 'Finance in Zurich' can be found at www.math.ethz.ch/finance and through several links from that page.

|

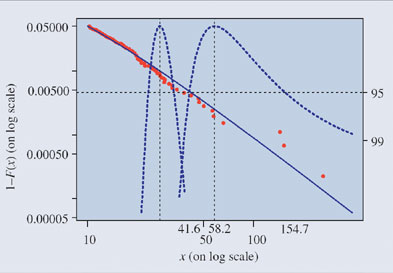

| Figure 2. EVT analysis

of insurance losss data. |

|

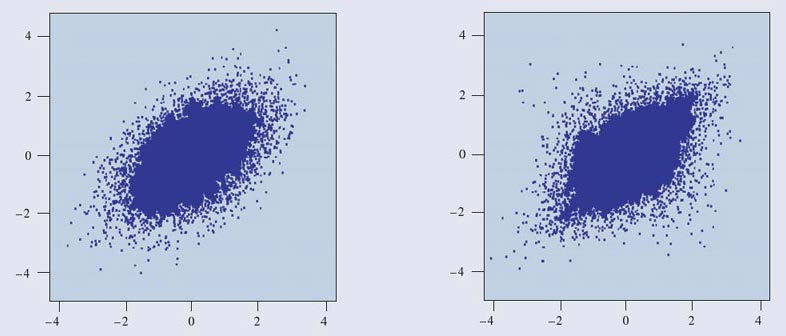

| Figure 3. Two portfolios, both with standard

normal margins, correlation 50% but different copulae: a normal copula for the

left picture, a t4 copula for the right one. |

Since its start in 1994, RiskLab has evolved with and within the world of banking and insurance. One constant that has remained is the idea of precompetitive research together with sponsoring partners from industry. No doubt, RiskLab will need to find its optimal position among the, by now, extensive offer of teaching and research in insurance and finance in Zurich and more generally in Switzerland. After the recent upheavals in financial markets more, not less, quantitative thinking concerning best practice risk management methodology is needed. It is certain that RiskLab, in one form or another, will keep on playing an important and internationally visible role in this discussion. At least one proof of its success is that its concept was copied on several occasions in other countries, as a Google search will quickly reveal.

Paul Embrechts, Director of RiskLab

| Back to Press Publications about RiskLab |

| Please send comments and suggestions to Uwe Schmock, email: schmock@math.ethz.ch. Last update: February 15, 2003 |